Cuando necesita hacer sus impuestos, es de gran importancia que se haga un trabajo de calidad. Cada año, millones de estadounidenses pagan más de lo que deberían en sus impuestos; accordando a CNBC Durante el año fiscal 2018, 16,7 millones de hogares realizaron deducciones detalladas en sus declaraciones de impuestos. Eso es menos que 46,2 millones de contribuyentes durante el año fiscal 2017. Estos errores pueden evitarse fácilmente con el trabajo de un contador experto. En Miami Tax Expert haremos todo lo posible para asegurarnos de que pague la menor cantidad posible en impuestos, respetando las pautas legales.

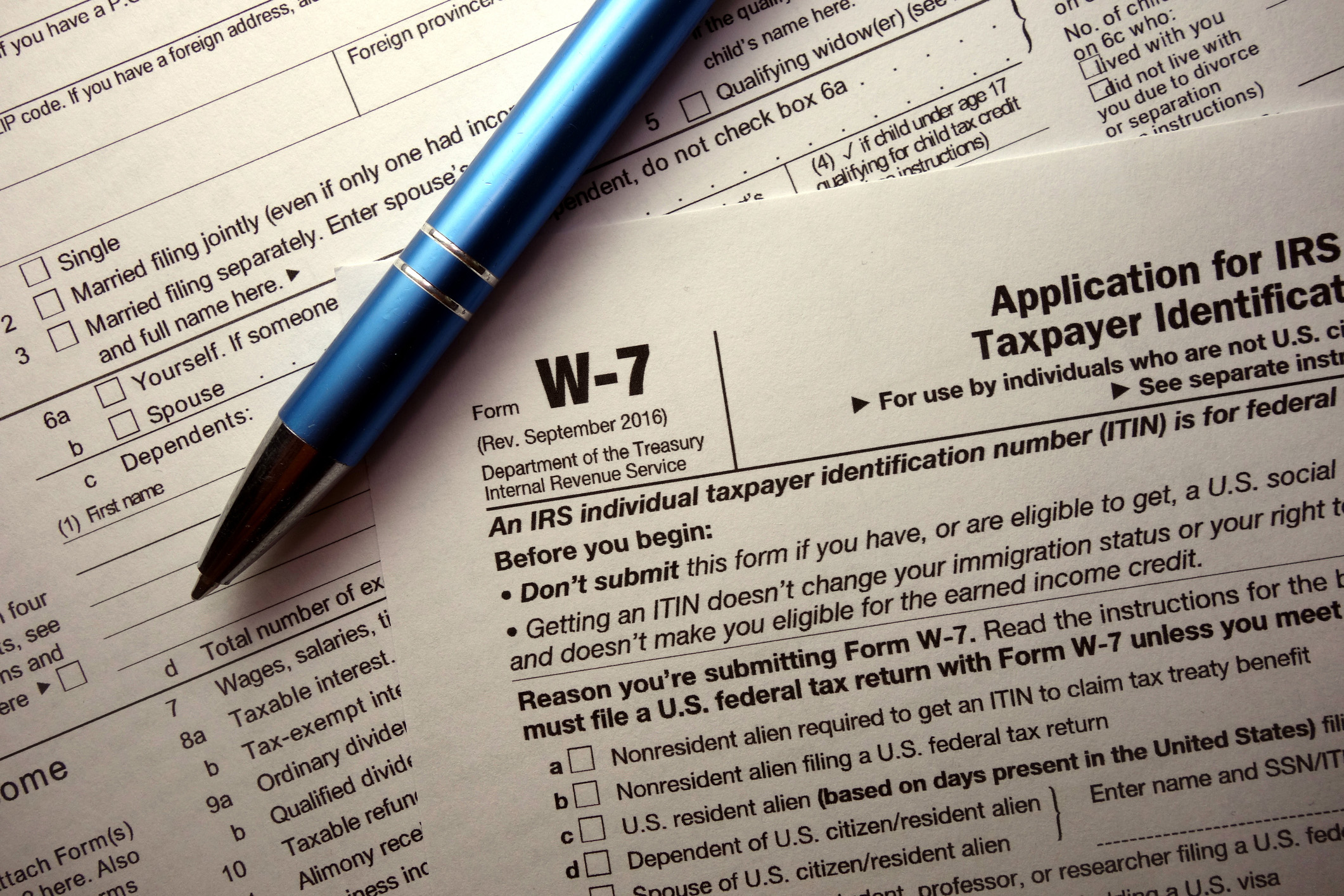

What is an ITIN, and what is it used for? An ITIN, or Individual Taxpayer Identification Number, is a tax processing number issued by the Internal Revenue Service(IRS). ITINs are issued by the IRS to people who require a U.S. taxpayer ID number but are ineligible to receive a Social Security Number. ITINs can be issued to anyone regardless of immigration status. Individuals must have a filing requirement and file a valid tax return to receive an

According to the IRS, you can deduct the lesser of $2,500 or the amount of interest you paid during the year from student loans. This deduction can be claimed as an adjustment to income, which means that the deduction does not need to be itemized. To claim a student loans interest deductions the following must apply to you: Paid interest on qualified student loan in 2017 tax yearHave a legal obligation to pay interest on

There are many scammers who will try and impersonate the IRS to steal your money and personal information, this list will show you how to detect and avoid these scams. These types of scams are typically referred to as “phishing.” First off, the IRS in most cases will send letters in the mail before calling you, however in some cases they will directly call you or meet you in person. If an IRS representative tries

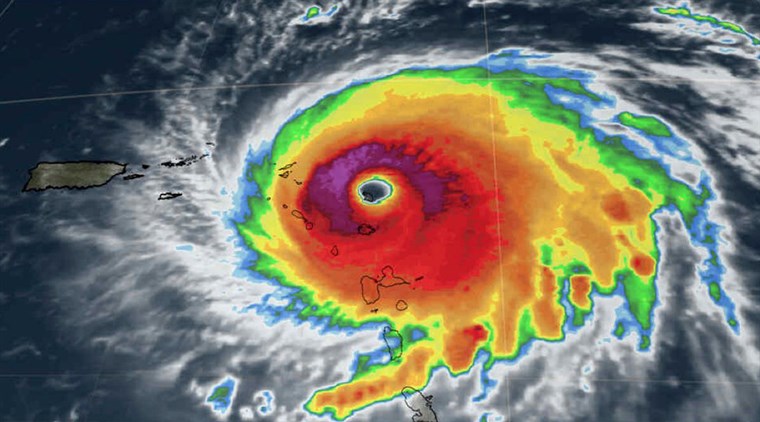

If you are a victim of the Hurricane Irma that took place in September of 2017 in Florida, you may qualify for tax relief from the IRS. The IRS is offering relief to certain counties that have been designated by FEMA, these counties are: Alachua, Baker, Bay, Bradford, Brevard, Broward, Calhoun, Charlotte, Citrus, Clay, Collier, Columbia, DeSoto, Dixie, Duval, Escambia, Flagler, Franklin, Gadsden, Gilchrist, Glades, Gulf, Hamilton, Hardee, Hendry, Hernando, Highlands, Hillsborough, Holmes, Indian River, Jackson, Jefferson, Lafayette,