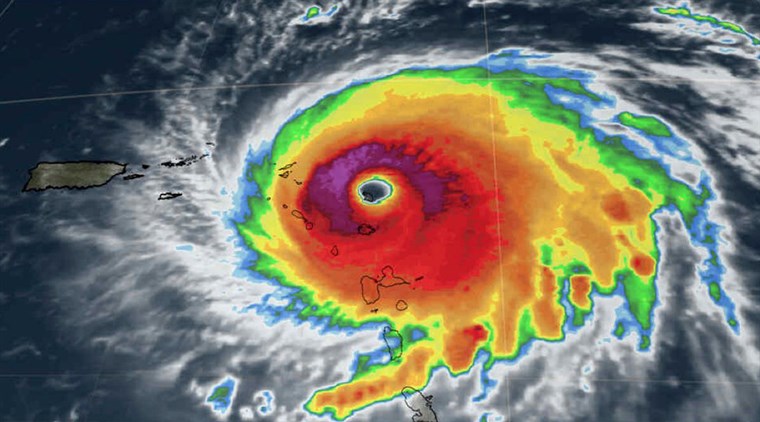

If you are a victim of the Hurricane Irma that took place in September of 2017 in Florida, you may qualify for tax relief from the IRS.

The IRS is offering relief to certain counties that have been designated by FEMA, these counties are: Alachua, Baker, Bay, Bradford, Brevard, Broward, Calhoun, Charlotte, Citrus, Clay, Collier, Columbia, DeSoto, Dixie, Duval, Escambia, Flagler, Franklin, Gadsden, Gilchrist, Glades, Gulf, Hamilton, Hardee, Hendry, Hernando, Highlands, Hillsborough, Holmes, Indian River, Jackson, Jefferson, Lafayette, Lake, Lee, Leon, Levy, Liberty, Madison, Manatee, Marion, Martin, Miami-Dade, Monroe, Nassau, Okaloosa, Okeechobee, Orange, Osceola, Palm Beach, Pasco, Pinellas, Polk, Putnam, Santa Rosa, Sarasota, Seminole, St. Johns, St. Lucie, Sumter, Suwannee, Taylor, Union, Volusia, Wakulla, Walton, Washington.

Hurricane Relief Workers, recognized government or philanthropic organizations, and any visitors who were killed or injured due to the hurricane may also be entitled to tax relief by the IRS. Taxpayers affected by Irma can also claim casualty losses on their federal income tax return and deduct property losses that are not covered by insurance.