What is an ITIN, and what is it used for?

An ITIN, or Individual Taxpayer Identification Number, is a tax processing number issued by the Internal Revenue Service(IRS). ITINs are issed by the IRS to people who require a U.S. taxpayer ID number but are inelligible to recieve a Social Security Number.

ITINs can be issued to anyone regardless of immigration status. Individuals must have a filing requirement and file a valid tax return to receive an ITIN number.

Who needs an ITIN?

The IRS issues ITINs to foreign nationals and others who have tax reporting or filing needs but are not eligible for a Social Security Number. You can call Miami Tax Expert, 305-810-8509, and find out if you need an ITIN.

How do I apply?

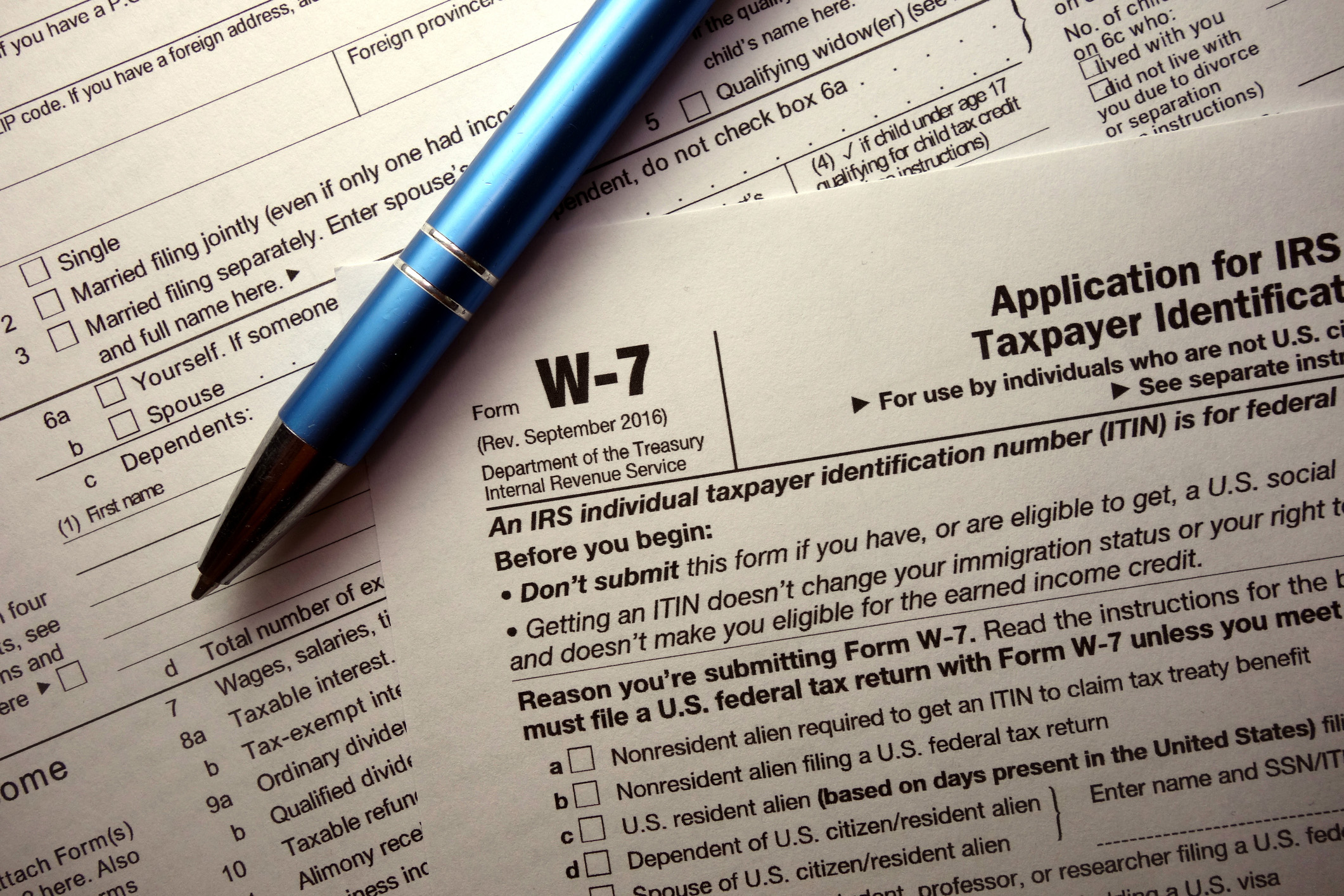

The IRS provides a W-7 form which requires a valid federal income tax return to be attached, along with proof of identity. You can contact Miami Tax Expert to receive assistance in filling out, and submitting a form W7/ITIN application by clicking here or download the form directly from the IRS here. As certifying acceptance agents you will not need to submit your passport to the IRS. We will handle the authentication as well as the required paperwork.